Credit reports contain information about an individual's background and credit history, and these reports are used to determine if someone is credit worthy. In short, if you pay your mortgage late, file for a bankruptcy, or are denied a credit card, all of these items will be recorded in your credit report.

Equifax, Trans Union, and Experian are the three major companies that compile credit information. These companies keep track of your addresses, mortgage payment history, checking accounts, credit card payment history and other similar information. They also list the balances you owe on your mortgage as well as credit cards. If you are a prompt payer of bills, this will be reflected in the credit reports. However, if you are habitually late with your monthly mortgage payment, store and bank credit cards, and have a judgment against you from a lawsuit, this will also show on your credit report.

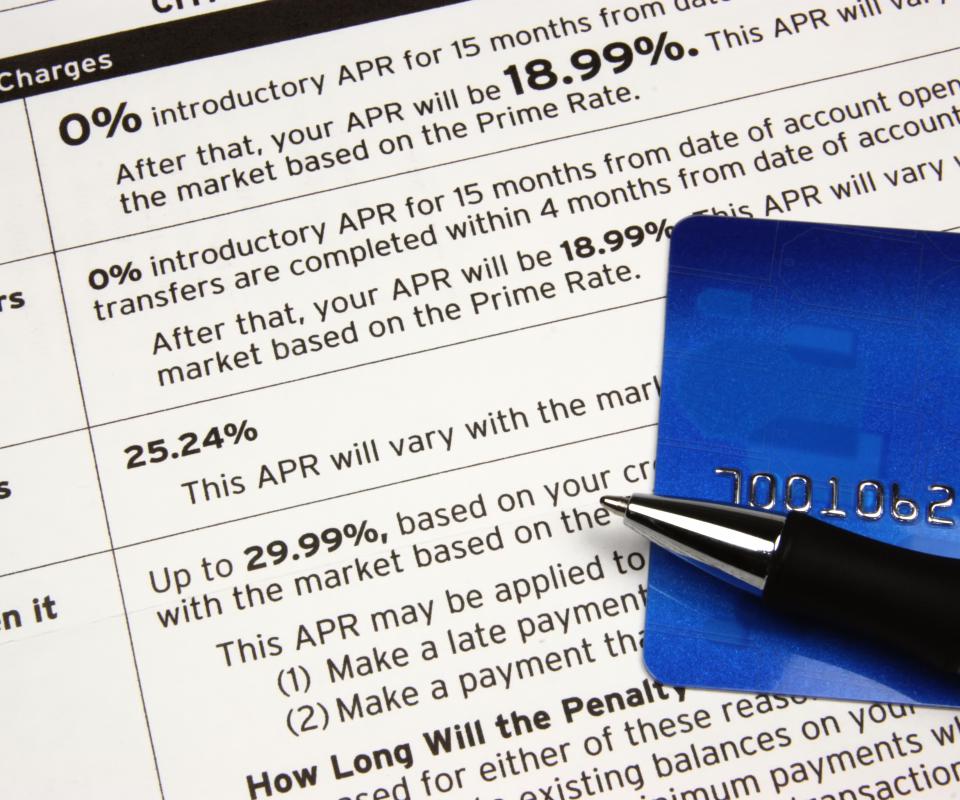

Based on your credit history, you are given a score. This score, in effect, determines the degree of your credit worthiness. It tells a bank or lender what the risks are if they offer credit to a consumer. For example, if your credit history demonstrates a lengthy on-time bill payment history and low outstanding non-mortgage debt, your strong score will allow you to get a loan with a great interest rate to buy that new car you've had your eye on. A poor score may result in an outright credit denial, or the loan for that very same car may come with an extremely high interest rate.

In order for a lender or other creditor to obtain a credit report, the consumer must give them authorization. If you have been denied a loan or credit card and you are wondering why, it would be wise to order your own credit report. While Equifax, Trans Union and Experian have been in the credit reporting business for quite some time, they are by no means infallible. You many find mistakes and inaccuracies on your report and such items can certainly weaken your credit score.

If you discover any inaccuracies in your credit report, you should notify the three major companies and supply them with the corrected information. If you, for example, had a judgment against you from a car accident, but you paid the judgment off, you should supply the companies with a "Release and satisfaction of judgment" so they can remove the judgment from your credit file.